texas auto sales tax

After you enter those into the blanks you will get the Dallas City Tax which is 01. A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax.

Which U S States Charge Property Taxes For Cars Mansion Global

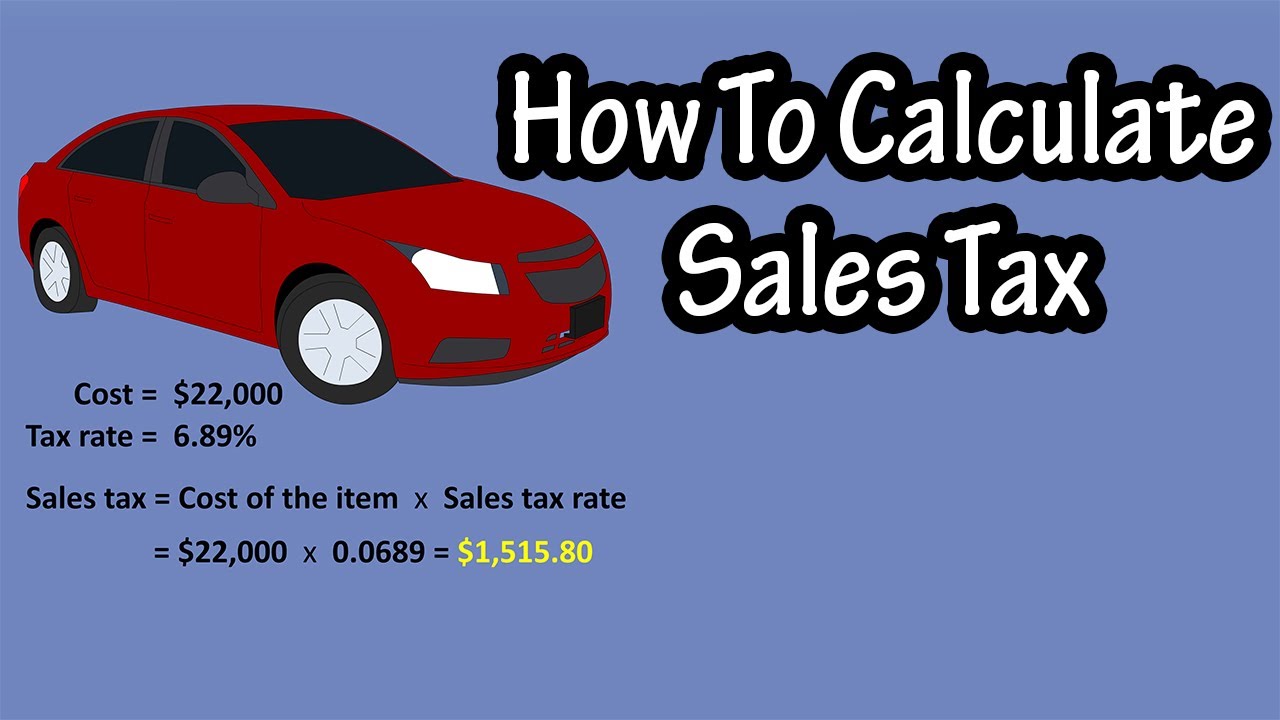

For example imagine you are purchasing a vehicle for 35000 with the state sales tax of 625.

. With local taxes the total sales tax rate is between 6250 and 8250. In another state for the same vehicle same price and same tax. This page covers the most important aspects of Texas sales tax related to the purchase of vehicles.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Estimate Tax Calculation For Buying A Used Motor Vehicle. The only requirement for this tax to.

The purchaser should issue the seller Form 14-312 Texas. Motor Vehicle Sales and Use Tax. For additional information see our Call Tips and Peak Schedule webpage.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value. Find your state below to determine the total cost of your new car including the car tax. Motor Vehicle Seller-Financed Sales Tax.

The leasing company may use the fair market value deduction to reduce the vehicles taxable value. Texas has 2176 special sales tax jurisdictions with local. 500 X 06 30 which is what you must pay in sales tax each month.

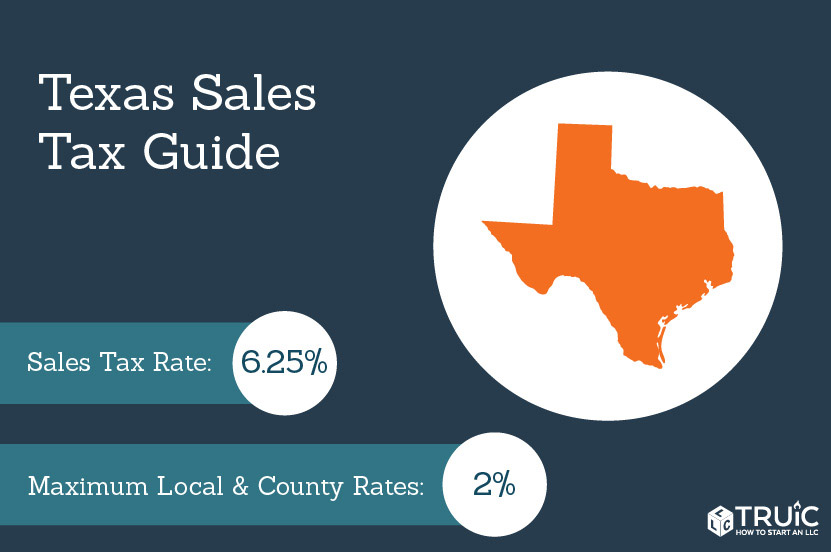

Using our Lease Calculator we find the monthly payment 59600. The use tax rate for the sale of a car in Texas is currently 625 of the price of the car for the 2023 calendar year. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales.

No tax is due on the lease payments made by the lessee. Our experienced sales and service staff is. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. For leased or leased vehicles see Taxation of leasing and rentals. The state sales tax rate in Texas is 6250.

How much tax is due. Motor Vehicle Texas Emissions Reduction Plan TERP Registration Surcharge. The sales tax for cars in Texas is 625 of the final sales price.

A vehicles SPV is its worth based on similar. You are going to pay 206250 in taxes on this vehicle. In Texas the value of your trade-in vehicle is not subject.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer Texas Comptroller of Public Accounts Form 14-317. If youre buying a car in Texas you can expect the car sales tax to be about 7928 on average. Texas has a statewide sales tax of 625 that applies to all car sales.

For example if your sales tax amounted to 100 you would owe 625 of that in use tax ie. For retail sales of new and used motor vehicles involving licensed motor vehicle dealers the motor vehicle sales tax is based on the sales price less any amount given for trade-in vehicle s andor dealer discounts. Texas Sale Tax information registration support.

The State of Texas imposes a motor vehicle sales and use tax of 625 of the purchase price on new vehicles and 80 of the Standard Presumptive Value non dealer sales of used vehicles. Texas Auto strives to provide the best vehicles and service possible to the dealership area. Forms for Motor Vehicle Sales and Use Tax.

Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6. If you buy from a private party such as a friend or relative the tax is 625 of. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

The minimum is 625 in Texas. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. The sales price if you paid 80 or more of the vehicles standard presumptive value SPV.

Again this is subject to change year to year. Texas collects a 625 state sales tax rate on the purchase of all vehicles. You can find these fees further down on.

SPV applies wherever you buy the vehicle in Texas or out of state. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle is titled. Tax is calculated on the leasing companys purchase price.

If you are buying a car for 2500000 multiply by 1 and then multiply by 0825. Ad New State Sales Tax Registration. For example if a purchaser traded in a vehicle worth 15000 to a licensed dealer as part of the purchase of a 42000 vehicle.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Select the Texas city from the list of popular cities below to see its current sales tax rate.

Some dealerships may charge a documentary fee of 125 dollars. To claim the exemption a purchaser must not use the motor vehicle in Texas except for transportation directly out of state and must not register the motor vehicle in Texas. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Motor Vehicle Local Sports and Community Venue District Tax for Short-Term Rentals. Vehicle purchases are among the largest current sales in Texas which means they can result in a high sales tax bill. The Texas Comptroller states that payment of motor vehicle sales.

If you buy the vehicle from a licensed dealer the tax is 625 of the sales price. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

Multiply the vehicle price after trade-in andor incentives by the sales tax fee. You trade-in a vehicle for 3000 and get an. New Texas residents pay a flat 9000 tax on each vehicle whether leased or owned when they establish a Texas residence.

1 for diesel vehicles in 1997 and newer vehicles over. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681 on top. 14-112 Texas Motor Vehicle SalesUse Tax Payment PDF 14-115 Texas Motor Vehicle Sales and Use Tax Report PDF For County Tax Assessor-Collector Use Only 14-116 Texas Motor Vehicle Sales and Use Tax Report Supplement PDF For County Tax Assessor-Collector Use Only 14-128 Texas Used Motor.

Local and county taxes are also applied to car sales and add about another 167 to the price of your purchase. Add this to the Dallas MTA tax at 01 and the state sales tax of 0625 combined together give you a tax rate of 0825. Motor Vehicle Texas Emissions Reduction Plan TERP Surcharge.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. Visit us today at our South location 16200 Hwy 3 Webster TX 77598 or our North locaton- 11655 North Fwy Houston TX 77060-our seasoned professionals are ready to answer any questions you may have. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax.

Texas has recent rate changes Thu Jul 01 2021.

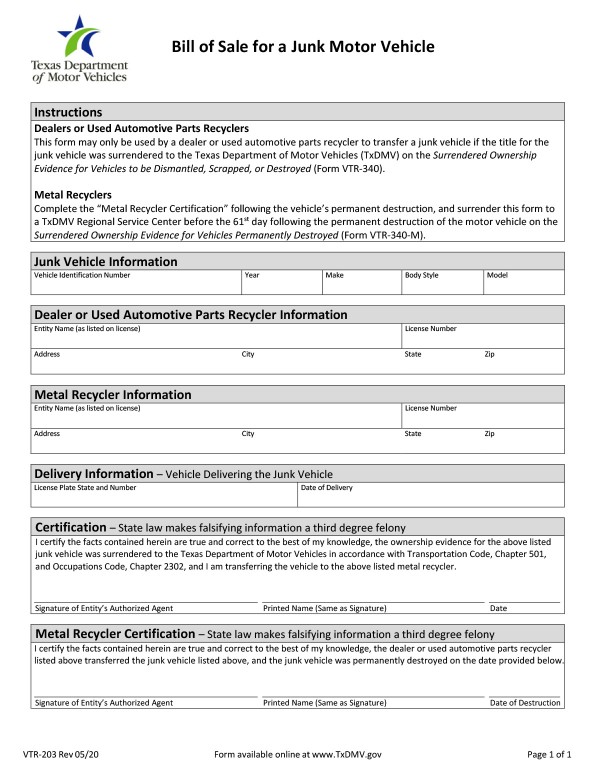

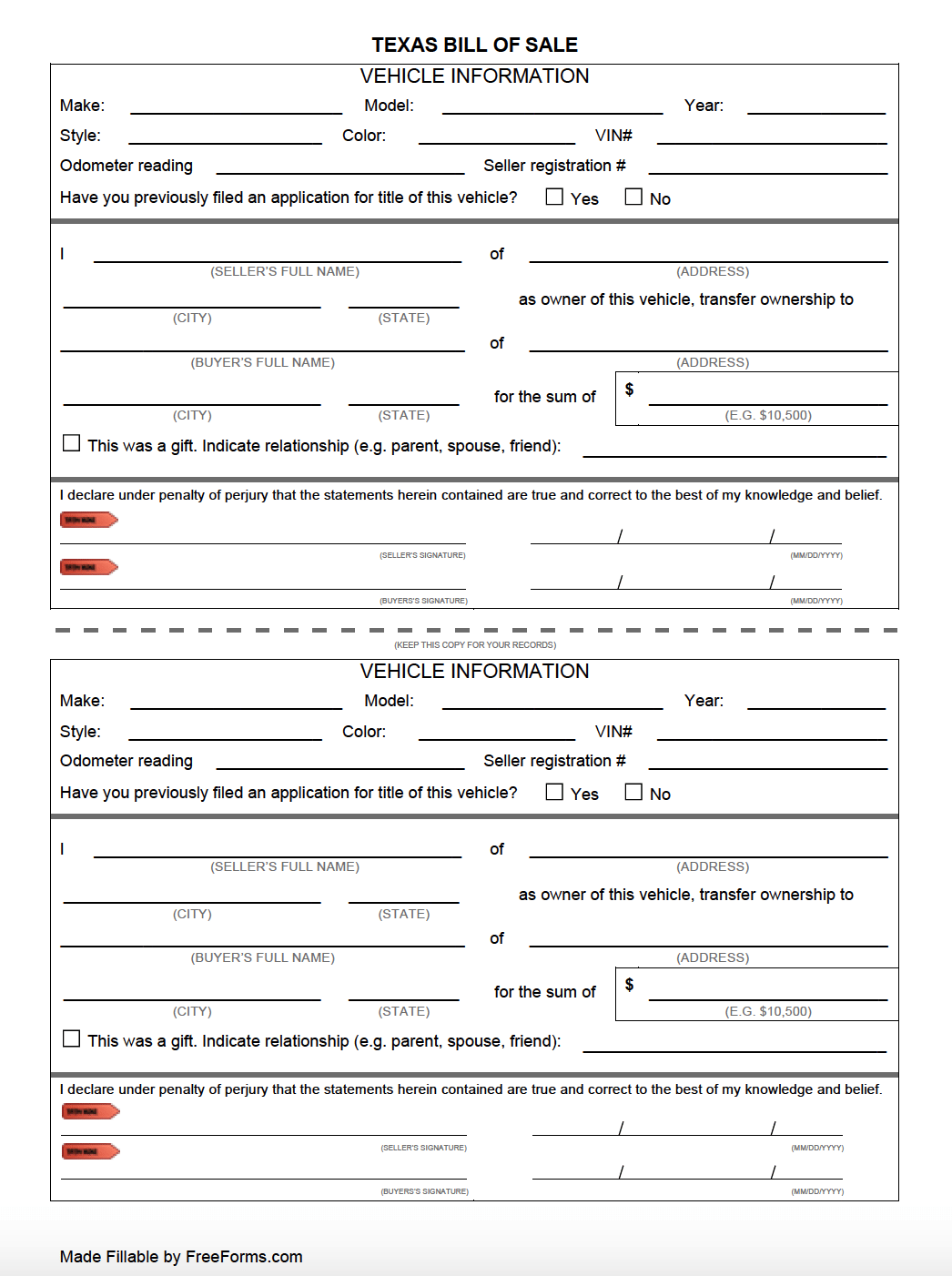

Texas Bill Of Sale Form Templates For Car Boat Fill Out And Download

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

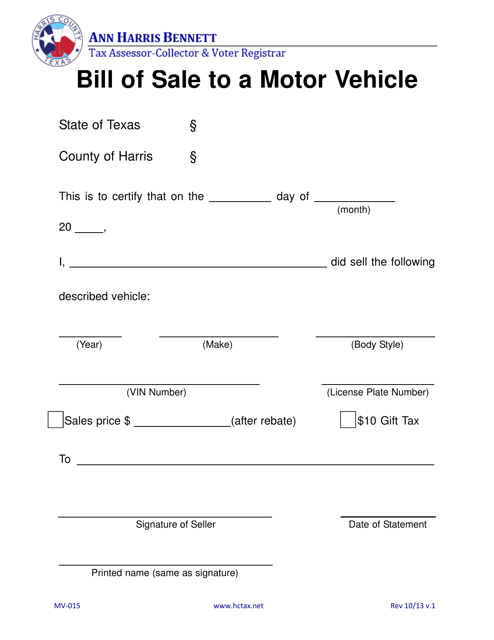

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller

Free Texas Bill Of Sale Form Pdf Word Legaltemplates

Texas Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Texas Used Car Sales Tax And Fees

Texas Car Sales Tax Everything You Need To Know

Electric Cars The Surge Begins Forbes Wheels

Texas Sales Tax Guide And Calculator 2022 Taxjar

What S The Car Sales Tax In Each State Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Free Texas Dmv Bill Of Sale Form For Motor Vehicle Trailer Or Boat Pdf

How To Gift A Car In Texas 500 Below Cars

What S The Car Sales Tax In Each State Find The Best Car Price

Registration Fees Penalties And Tax Rates Texas

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos